Analysis of Final 2018 QPP Rule

Overview and Summary of Key Provisions

On November 2, 2017 the Centers for Medicare & Medicaid Services (CMS) released the final rule outlining performance year (PY) 2018 policies for the Quality Payment Program (QPP), which corresponds with 2020 payment adjustments for Medicare Part B payments. The rule finalizes policies related to both of the QPP tracks, one for providers in Advanced Alternative Payment Models (Advanced APMs) and the other for those in the Merit-Based Incentive Payment System (MIPS). A link to the final rule is available here along with this CMS factsheet. NAACOS issued a press release in response to the final rule, which is available here. Below is an overview of the key issues affecting ACOs.

For Advanced APMs policies, CMS:

In relation to MIPS, CMS:

Advanced APM Policies

Advanced APM Participation Growth

CMS estimates the number of providers qualifying for Advanced APM bonuses will double in the second year of the program. The agency estimates that around 70,000 to 120,000 providers will earn Advanced APM bonuses in the first performance year of the program and in the second year that number will grow to between 185,000 and 250,000. This expected growth is due in large part to reopening of the Next Generation ACO Model and CPC+ for 2018 and the introduction of the Medicare Shared Savings Program (MSSP) Track 1+. Overall, CMS estimates the agency will pay aggregate 2020 Advanced APM bonuses between $675 million and $900 million.

Advanced APM Risk Thresholds

A key criterion for an APM to be designated as “advanced” is that the model requires a sufficient amount of risk. In the rule, CMS finalized its proposal to maintain the current revenue-based nominal amount standard at 8 percent of the average estimated total Medicare Parts A and B revenue of all providers and suppliers in participating APM Entities for the 2019 and 2020 performance periods. CMS notes it may consider changing this revenue-based threshold after 2020. There are no changes for the 3 percent benchmark-based standard, and CMS is not taking action to create a lower revenue-based nominal amount standard for small or rural practices but may consider this in the future. The amount of required risk for APMs considered under the Medical Home Model standard is different and CMS is lowering the standard for PY 2018 from 3 percent to 2.5 percent. The table below details the revised minimum risk levels under the Medical Home Model risk standards.

Nominal Risk Thresholds for Medical Home Models

| QP Performance Period | % of Ave. Estimated Total Medicare Part A and B Revenue for All Providers/Suppliers in Participating APM Entity in a Medical Home Model |

| 2018 | 2.5% |

| 2019 | 3% |

| 2020 | 4% |

| 2021 and beyond | 5% |

APMs Introduced During the Performance Year

CMS finalized a policy for providers in new Advanced APMs that start during a performance year to have an opportunity to qualify for Advanced APM bonuses. Those that start during the performance period can qualify for bonuses as long as they participate for at least 60 continuous days during the performance period (January 1 through August 31). CMS also modified the timeframe for the data included in the QP calculations for APM Entities participating in new Advanced APMs, and CMS will calculate QP Threshold Scores using only data in the numerator and denominator for the dates that APM Entities participated.

Eligible Clinician Participation in Multiple Advanced APMs

CMS proposed to amend its regulations to make clear that if an EC was determined to be a QP based on participation in multiple Advanced APMs, but any of the APM Entities in which he or she participated terminated from the APM before the end of the QP Performance Period, the EC would not be a QP. NAACOS opposed this proposal and CMS amended its policy. Under the final policy, when an EC is in multiple APM Entities participating in multiple Advanced APMs and one or more APM Entities terminates during the performance period, CMS will evaluate whether the EC’s participation in the remaining Advanced APMs would meet the relevant QP or Partial QP Thresholds. As a reminder, ECs are only evaluated using participation in multiple Advanced APMs if none of their corresponding Advanced APM Entities meet the QP thresholds as a collective entity.

Medical Home Model Size Restrictions

CMS requirements stipulate that beginning with the 2018 performance period the Medical Home Model standard will only apply to APM Entities with fewer than 50 ECs. Under this policy, in order to qualify for Advanced APM bonuses CMS requires that these APM Entities either are themselves comprised of fewer than 50 ECs or are owned/operated by an organization with fewer than 50 ECs. While this policy remains in effect generally, CMS finalized an exception for entities participating in the CPC+ Model as of January 1, 2017. Therefore, organizations in CPC+ Round 1 will remain eligible for the Advanced APM bonus regardless of their practice size or relationship to a parent organization. Unfortunately, and despite repeated requests from NAACOS to do so, CMS did not modify its policy that MSSP Track 1 ACO primary care practices are not eligible for Advanced APM bonuses based on their Track 1 or CPC+ participation.

All-Payer Combination Option

Overview, Risk Standard and MA Demonstration

While QP determinations are only based on traditional Medicare Advanced APM participation in the early years of the QPP, beginning with PY 2019 CMS will give credit for qualifying APM participation with payers outside of Medicare, including Medicare Advantage (MA), Medicaid and eventually other commercial plans. Please note that under this All-Payer Option CMS will still require Medicare APM participation, and this option is for those that do not meet QP thresholds based on their Medicare APM participation alone. CMS finalized details for how the process of evaluating and approving “Other Payer” Advanced APMs will work. Developing a robust All-Payer Option will be especially important as the QP thresholds become increasingly challenging in future years. In response to NAACOS advocacy, CMS finalized its proposal to add a revenue-based nominal amount standard of 8 percent to the All-Payer Option, which matches the standard for Medicare Advanced APMs. This will allow Other Payer APMs with risk levels based on revenue to qualify as Advanced and is in addition to the 3 percent benchmark-based risk standard CMS previously finalized.

Despite calls from NAACOS to do so, CMS did not change the timeframe for the All-Payer Option, with 2019 as the first performance period (related to the 2021 payment year). However, in this final rule CMS discusses developing a demonstration in 2018 to test the effects of incentives for participating in alternative payment arrangements under MA that qualify as Advanced APMs. This could give credit for participation in qualifying MA arrangements prior to 2019 and importantly would create an opportunity for participation in MA Advanced APMs alone to allow providers to qualify for Advanced APM bonuses (without concurrent participation in a Medicare Advanced APM). NAACOS will comment to CMS in support of this demonstration and will underscore the need to allow ACOs to participate along with other providers.

CMS Determination of Whether Other Payer APMs Qualify as Advanced

In order for CMS to evaluate and subsequently give credit for participation with Other Payer Advanced APMs, the agency must first determine whether a specific Other Payer APM meets the required criteria. CMS will approve Other Payer APMs based on those submitted for review by the agency. Requests are voluntary and can be submitted by payers or providers. Under the Payer Initiated Process, payers, including Medicaid, MA and those involved in CMS Multi-Payer Models can request review of their payment arrangements. Through the Eligible Clinician Initiated Process, ECs or APM Entities such as ACOs can request a review of their payment arrangements. CMS will begin to review requests submitted by payers as early as the year prior to the performance year and plans to make determinations under Payer Initiated Process before the QP Performance Period. CMS will post approved Other Payer Advanced APMs on a public website. Submission for the EC Initiated Process would take place from August 1 to December 1, though information would be submitted earlier for Medicaid APMs. This sequential approach of the Payer Initiated Process followed by the EC Initiated Process aims to alleviate burdens on providers who would not need to submit information for payment arrangements approved through the Payer Initiated Process. CMS will update the website to include additional payment arrangements approved through the EC Initiated Process. Please refer to Table 42: Timeline for Other Payer Advanced APM Determination Process for the 2019QP Performance Period by Payer Type on page 53868 of the final rule for submission timeframes.

CMS will share determinations about Other Payer arrangements “as soon as practicable.” For each process, CMS will develop forms detailing what information and supporting documentation is required. Under the EC Initiated Process, CMS will presume an Other Payer APM meets the requirement for 50 percent Certified Electronic Health Record Technology (CEHRT) use if the agency receives documentation showing the APM requires the ECs to use CEHRT. Despite requests for designations to last longer, CMS will require annual determinations. However, CMS may later evaluate using multiple year determinations.

All-Payer QP Performance Period and QP Calculation

CMS finalized that the QP performance period for the All-Payer Option will match that for the Medicare, beginning January 1 and ending August 31 of the calendar year two years prior to the payment year. Both will collectively be referred to as the QP Performance Period and there will not be a distinction between them. As with the Medicare Option, CMS will make QP determinations based on three snapshot dates: March 31, June 30 and August 31, and an EC or APM Entity will need to meet the relevant QP or Partial QP threshold under the All-Payer Option for at least one of these. Data for QP determinations does not need to be submitted for all three time periods. If information for only the first two periods is provided, CMS will make the QP determination without any disadvantage for not submitting data for the final period.

In response to NAACOS advocacy, CMS did not finalize its proposal to only make All-Payer QP determinations at the individual clinician level. This reversal lessens administrative burdens and reinforces the role of the ACO in the All-Payer Option. CMS will still allow ECs to request a QP determination at the EC level, but the agency will also allow an ACO or APM Entity to request a QP determination at the APM Entity level. CMS notes that in cases where QP determinations are requested at the APM Entity level, the agency expects that the composition of the APM Entity will be generally consistent across the Medicare Advanced APM(s) and Other Payer Advanced APM(s). Should that not be the case, CMS expects the EC would request the QP determination at the EC level. In the event that CMS receives a request for QP determination from an individual EC and also separately receives a QP determination request from that EC’s APM Entity, CMS would make a determination at both levels, and the EC could become a QP on the basis of either of the determinations. CMS does not specify when ECs or APM Entities would be informed of their QP status, stating that would occur “as soon as practicable” after the submission deadline.

All-Payer QP Calculations

QP determinations are based on the more favorable calculation when evaluating payments and patient counts. In order for CMS to conduct QP calculations and make QP determinations based on payers other than Medicare, detailed information must be provided to the agency about payments and patients for Other Payer APM arrangements. As a result of CMS’s modified policy to make evaluations at the APM Entity level or the individual EC level, the payment and patient count information must be submitted accordingly. Specifically, if an individual EC requests a QP determination, payment and patient information must be submitted at the individual EC level, and if an APM Entity requests a QP determination, then information must be submitted at the APM Entity level. This information will have to be submitted using a CMS form by December 1 of the performance year.

CMS will calculate the payment amount approach by dividing the numerator (defined as the aggregate amount of all payments from all payers, except those excluded, attributable to the EC or to the APM Entity under the terms of all Advanced APMs and Other Payer Advanced APMs during the QP Performance Period) by the denominator (defined as the aggregate amount of all payments from all payers, except those excluded, made to the EC or to the APM Entity’s providers during the QP Performance Period). CMS would use a similar approach with the patient count approach. Specifically, the agency would divide the numerator (defined as the number of unique patients to whom an APM Entity’s providers or an EC furnishes services that are included in the measures of aggregate expenditures used under the terms of all Advanced APMs and Other Payer Advanced APMs during the QP Performance Period) by the denominator (defined as the number of unique patients to whom the APM Entity or EC furnishes services under all non-excluded payers during the QP Performance Period).

ECs or APM Entities, who do not meet the QP thresholds under the Medicare or the All-Payer Option but who do meet the lower Partial QP thresholds, can elect whether they want to report on MIPS and receive any resulting payment adjustments under that program. As a reminder, Partial QPs are not eligible for the Advanced APM bonuses. For ECs or APM Entities, CMS requires that documentation pertaining to Other Payer determinations must be retained for a period of six years from the end of the QP performance period or the date of completion of evaluation, inspection or audit (whichever is latest). Also, when an APM Entity submits information to request an Other Payer Advanced APM determination, the certification must be made by an individual with the authority to bind the payer or APM Entity.

Physician-Focused Payment Models

MACRA established the Physician-Focused Payment Model Technical Advisory Committee (PTAC) to review proposed physician-focused payment models (PFPMs) submitted by individuals and stakeholders. PTAC is a federal advisory committee that reviews these models and provides advice to the Secretary of Health and Human Services (HHS) and recommendations about whether various models meet criteria set forth by CMS. The agency previously finalized that PFPMs be tested as APMs with Medicare as a payer and CMS had proposed to broaden the definition of PFPMs to include payment arrangements that involve Medicaid or the Children’s Health Insurance Program (CHIP) as a payer even if Medicare is not included. However, CMS did not finalize its proposal to include additional payers and PTAC will remain focused exclusively on Medicare payment arrangements.

Merit-Based Incentive Payment System

CMS finalized many of the proposed changes to MIPS for 2018, however the main components and structure of the program remain in place. CMS makes a number of changes to benefit small practices, providing an exclusion from Advancing Care Information (ACI) reporting, a bonus opportunity for small groups, and a new “virtual group” option that will launch in 2018. Notably, CMS also finalized changes to the low volume exception criteria, which will exclude far more clinicians from the MIPS program. By CMS’s estimates, this will exclude an additional 540,000 clinicians from MIPS. One significant change finalized is that beginning with PY 2018 CMS will begin to incorporate cost into the composite MIPS performance scores for those subject to general MIPS requirements. The agency originally proposed to exclude the cost category again in 2018, however after pushback from NAACOS and other stakeholders urging the agency to begin to hold clinicians accountable for both quality and cost, the agency reversed its decision and finalized a 10 percent cost category for clinicians under the general MIPS scoring requirements in MIPS. The total impact of these changes, however, significantly reduces the opportunities for bonus payments in MIPS due to the budget neutrality requirements of the program.

General MIPS Requirements

Changes to MIPS Performance Thresholds

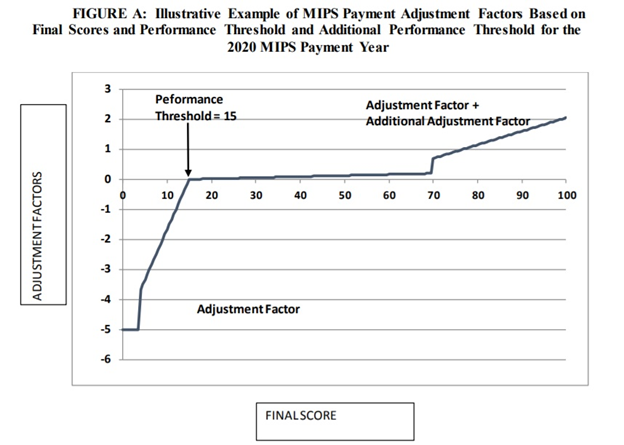

CMS finalized a policy to increase the performance threshold in 2018 from three points to 15 points, while maintaining the 70-point threshold for exceptional performance. CMS estimates approximately 622,000 clinicians will be subject to MIPS in PY 2018, and positive payment adjustments are expected to be minimal. In Figure A below (page 53796) CMS provides an illustrative example of MIPS payment adjustment factors based on final scores and the final performance threshold for the 2020 payment year. Figure A estimates that a clinician scoring 100 points (the maximum possible points) in MIPS based on 2018 performance will receive merely a 2.05 percent bonus payment in 2020.

For MIPS ECs with a final score of 100, the adjustment factor will be 5 percent times a scaling factor greater than zero and less than or equal to 3.0. The scaling factor is used to ensure budget neutrality and cannot exceed 3.0. The additional adjustment factor for exceptional performance will start at 0.5 percent and cannot exceed 10 percent. MIPS ECs at or above the additional performance threshold of 70 points will receive the amount of the positive adjustment factor plus the additional adjustment factor. NAACOS expects many ACOs will meet the exceptional performance threshold.

Making Changes to the Low-volume Exception

CMS finalized changes to the low volume threshold to allow more ECs the opportunity to meet the threshold and, therefore, be exempt from MIPS reporting. Specifically, CMS increased the threshold from $30,000 or 100 or fewer Medicare patients to $90,000 or 200 or fewer Medicare patients seen in the measurement period. CMS estimates this will exclude an additional 540,000 clinicians from the MIPS.

Special Considerations for Small Practices

CMS made a number of changes to benefit small practices and solo practitioners including: providing exemptions for small practices in the ACI performance category; creating a new bonus opportunity available to small practices (to be added to the final MIPS performance score); and implementing a new virtual group option for MIPS participation for groups of 10 or fewer providers who want to aggregate performance data for purposes of MIPS analysis. These exemptions generally are not applicable to ACOs, which will continue to report and be evaluated as an ACO entity in the MIPS program. However, it is helpful to be aware of these policy changes in order to discuss the alternative options afforded to small practices in MIPS. Finally, is important to note this clarification from CMS in the final rule: when group(s) choose a virtual group participation and are also part of an APM Entity like an ACO, the APM Entity participation will trump the virtual group election. NAACOS has developed talking points for ACOs to clearly communicate the benefits of continued participation in the ACO program as it relates to MACRA and MIPS evaluation.

Including a Cost Performance Category Analysis in 2020

CMS reversed its proposal to continue the policy to exclude the cost performance category analysis for ECs in MIPS. After pushback from stakeholders including NAACOS, the agency finalized a policy to begin to incorporate cost in MIPS performance scores starting with PY 2018, which corresponds to 2020 payments. Specifically, the agency finalized a 10 percent cost category contribution to the overall MIPS score for those subject to the general MIPS requirements. As a reminder, ACOs are excluded from a cost analysis as part of their overall MIPS score due to the fact that the MSSP and/or Next Generation Model programs already evaluate ACOs on cost.

Public Reporting of MIPS Performance Data

CMS finalized a policy to continue adding MIPS performance information to the Physician Compare website. Currently, Physician Compare users can view information about Medicare clinicians, such as: name; Medicare primary and secondary specialties; practice locations; group affiliations; hospital affiliations, Medicare assignment status; education; residency; and board certification information. CMS also recently added ACO-specific data such as a notation when a clinician participates in an ACO as well as 19 quality measures for ACOs participating in the MSSP.

Further, MACRA requires CMS to also publicly report performance information, as detailed in the 2017 QPP final rule, including:

Review and Appeals Process

In the 2017 QPP final rule, CMS finalized that MIPS ECs or groups may request a targeted review of the calculation of the MIPS payment adjustment factor, including clinicians scored under the MIPS APM scoring standard such as ACOs. CMS does not make changes to the targeted review process in this final rule. CMS will provide MIPS ECs and groups with a 60-day period to submit a request for targeted review, which will begin on the day CMS makes the MIPS payment adjustment factor available to the public for the MIPS payment year. CMS will provide further information on this process in the future.

|

MIPS Scoring |

||

|

Total Points Scored in MIPS |

Resulting Payment Adjustment |

Notes Regarding ACO Performance |

|

0 points |

Negative payment adjustment of -5%

|

ACOs reporting quality data through MSSP and/or the Next Generation Model will automatically avoid this penalty |

|

15 points |

Neutral payment adjustment |

ACOs receive an automatic full credit for the Clinical Practice Improvement Activities (CPIA) performance category, this combined with quality performance scores will likely earn them the minimum 15 points required for a neutral payment adjustment |

|

16-69 points |

Positive payment adjustment |

Payment adjustment amount to be determined following the performance year. ACOs scoring between 16 and 69 points will not be eligible for an exceptional performance bonus |

|

>70 points |

Positive payment adjustment for exceptional performers |

ACOs scoring at or above 70 points will earn the additional, exceptional performance bonus of .5% or greater |

Complex Patient Bonus

CMS also finalized a bonus opportunity for those seeing a large proportion of high-risk patients, which is applicable to ACOs scored under the APM Scoring Standard. CMS finalized a policy to calculate the complex patient bonus for APM Entities and virtual groups by adding the beneficiary weighted average Hierarchical Condition Categories (HCC) risk score for all MIPS ECs (and if technically feasible, TINs for models and virtual groups which rely on complete TIN participation such as the MSSP) within the APM Entity or virtual group to the average dual eligible ratio for all MIPS eligible clinicians (and if technically feasible, TINs for models and virtual groups which rely on complete TIN participation) within the APM Entity or virtual group, multiplied by 5.

Under the HCC calculation for MIPS APMs, including ACOs, CMS will use the beneficiary weighted average HCC risk score for all MIPS ECs, and if technically feasible, TINs for models that rely on complete TIN participation such as the MSSP. CMS will calculate the weighted average by taking the sum of the individual EC’s (or TIN’s as appropriate) average HCC risk score multiplied by the number of unique beneficiaries cared for by the clinician and then divide by the sum of the beneficiaries cared for by each individual clinician (or TIN) in the APM Entity.

Under the dual eligible calculation, CMS will use the average dual eligible patient ratio for all MIPS ECs, and if technically feasible, TINs for models that rely on complete TIN participation. CMS will use data on dual-eligibility status sourced from the state Medicare Modernization Act (MMA) files, submitted by each state to CMS with monthly Medicaid eligibility information analyzing claims from September 1, 2017 to August 31, 2018. The complex patient bonus will be worth a maximum of five points, and the bonus will be added to the final MIPS score. For examples of HCC and dual eligible status calculations, see Table 27 in the final rule (p. 53776).

MIPS APM Scoring Standard

CMS continues to evaluate ACOs under the MIPS APM Scoring Standard. The general weights for each MIPS performance category under the APM Scoring Standard remain unchanged. For more information on the finalized MIPS APM Scoring Standard policies for 2017 performance, please access NAACOS’s resourceThe ACO Guide to MACRA.

|

MIPS APM Scoring Standard Performance Category Weights |

||

|

|

MIPS APM Weight for ACOs |

Generally Applicable MIPS Weight |

|

Quality |

50% |

50% |

|

Cost |

0% |

10% |

|

Advancing Care Information |

30% |

25% |

|

Improvement Activities |

20% |

15% |

Including a Fourth Snapshot Date

CMS finalized a policy to include a fourth snapshot date to determine which ECs are participating in the ACO for purposes of MIPS APM Scoring Standard evaluation. This additional snapshot date will occur on December 31, 2018 to ensure that an EC who joins an ACO TIN late in the performance year would be scored under the APM Scoring Standard along with the rest of the ACO. The remaining snapshot dates will also continue to be in place (March 31, June 30 and August 31). As a reminder, to identify ECs who are part of a MIPS APM, CMS uses the same approach as identifying ECs who are part of an Advanced APM Entity. This includes the use of these snapshot dates which establish and then add ECs to the MIPS APM during the performance year. For MSSP ACOs in MIPS, this means that CMS will identify ECs who reassign their Medicare billing rights to an ACO Participant TIN on the snapshot dates; the reassignment data is exported from the Provider Enrollment, Chain and Ownership System (PECOS). Note that the additional, fourth snapshot date would only apply to MIPS APM evaluations (not Advanced APM Entity evaluations).

Quality Performance Category

CAHPS for ACOs Survey Measure

CMS finalized a policy to add the Consumer Assessment of Healthcare Providers and Systems (CAHPS) for ACOs survey in the MIPS quality performance score analysis starting with PY 2018. Most questions in the CAHPS for ACOs survey can also be found in the CAHPS for MIPS survey except for one question (“Between Visit Communication”) that CMS feels is inappropriate for use by ACOs and will therefore not be included in the ACO’s MIPS quality score.

Improvement Points

CMS finalized a new opportunity for additional points to be earned for quality improvement year over year in MIPS, which will also be applicable to ACOs scored under the APM Scoring Standard. This will compare quality scores from the prior performance period and will be measured at the performance category level (rather than at the measure level). Up to 10 percentage points are available in this performance category. Specifically, CMS finalized that the improvement percent score will be calculated by dividing the increase in the quality performance category achievement percent score of an individual MIPS eligible clinician or group (calculated by comparing the quality performance category achievement percent score from the prior performance period to the current performance period) by the prior performance period’s quality performance category achievement percent score, and multiplying by 10 percent. For an example, please see Table 24 in the final rule (p. 53746).

Assigning Points Based on Benchmarks

CMS continues its policy to score quality measure performance under the APM scoring standard using a percentile distribution, separated by decile categories. For each benchmark, CMS will calculate the decile breaks for measure performance and assign points based on the benchmark decile range into which the APM Entity’s measure performance falls. CMS will continue to use a graduated points-assignment approach, where a measure is assigned a continuum of points out to one decimal place, based on its place in the decile. For example, a raw score of 55 percent would fall within the sixth decile of 41.0 percent to 61.9 percent and would receive between 6.0 and 6.9 points. See Table 11 which outlines the benchmark decile distribution (p. 53699).

ACI Performance Category

The ACI performance category will require a minimum 90-day reporting period for PY 2018 and will not require the use of 2015 CEHRT, although bonus points will be provided to those who choose to use 2015 CEHRT exclusively. For 2018 the ACI performance category includes new exemptions for certain measures but otherwise maintains the same scoring methodology. Also, per the 21st Century Cures Act, ECs in Ambulatory Surgical Centers (ASCs) will be exempt from ACI requirements and will have their ACI performance category reweighted to 0 percent of their total overall MIPS score. CMS will provide more details on this exemption status later in 2017. CMS also maintains the same scoring structure for this performance category for 2018, including Base Score and Performance Score components to the overall ACI performance category score. See Table 7 in the final rule for an outline of the 2018 final ACI performance category scoring methodology (p. 53676). Table 8 outlines 2018 final ACI performance category scoring methodology for Transition Objectives and Measures (p. 53677).

CMS also includes language to provide additional information to APM entities regarding how those ECs who qualify for a zero percent weighting in the ACI performance category may or may not be included for purposes of the group/practice and ACO entity level ACI scores. Specifically, on page 53701, CMS states:

“If a MIPS eligible clinician qualifies for a zero percent weighting of the advancing care information performance category as described in II.C.6.f.(6) of this final rule with comment period as an individual, but receives an advancing care information score as part of a group, we will use that group score for that eligible clinician when calculating the APM Entity’s advancing care information performance category score. We note that group level advancing care information reporting is not negatively affected by the failure of a single individual to report because it is based only on average reported performance within the group, not the average reported performance of all eligible clinicians in the group—those who do not report are not factored into the denominator. If, however, all MIPS eligible clinicians in a TIN qualify for a zero percent weighting of the advancing care information performance category, the entire TIN will be removed from the numerator and denominator, and therefore contribute a null value when calculating the APM Entity score.”

Exclusions and Bonus Opportunities Expanded

In 2018 CMS will provide certain exclusions for the e-prescribing and Health Information Exchange measures in the ACI performance category. These exclusions will be effective for the 2017 performance period as well. Specifically, CMS adds the following exclusions:

CMS also expands bonus options for 2018 for the ACI performance category. A five percent bonus is available for submitting to an additional public health agency or clinical data registry not reported under the performance score. Additionally, a 10 percent bonus is available for using the 2015 Edition exclusively.

Clinical Practice Improvement Activities Performance Category

CMS does not make changes to the way ACOs are evaluated in the Clinical Practice Improvement Activities (CPIA) performance category for 2018. ACOs will not have to report any CPIA information in 2018 and will receive full credit for this performance category for participation in the ACO program. Therefore, ACOs earn 40 points, receiving full credit in this performance category. More information is available in this CMS fact sheet.

Cost Performance Category

CMS finalized the policy to continue to not evaluate ACOs on cost in MIPS due to the fact that the MSSP and Next Generation Model already evaluate ACOs on cost.

Performance Feedback

In the final rule, CMS states it will provide quality and cost feedback on the performance categories “as technically feasible” for MIPS APMs. NAACOS will continue to advocate for CMS to provide relevant, timely and transparent performance information to ACOs on their MIPS performance.

Multiple MIPS Scores in a Performance Year

Tables 30 and 31 illustrate the final policies for determining which final score will be used when more than one final score is associated with a TIN/NPI (Table 30) and the final policies that apply if there is no final score associated with a TIN/NPI from the performance period, such as when a MIPS eligible clinician starts working in a new practice or otherwise establishes a new TIN (Table 31), both found on page 53787.