- Home

- About Us

- Membership

- Partners

- Resources

- Education & Events

- Advocacy

- Advocacy Letters

- COVID-19

- Shared Savings Program

- Medicaid ACOs

- CMMI Models

- ACO Program Elements

- Quality and Equity

- Congress

- Payment Rules

- Other Regulations

- News

- ACO News

- NAACOS Blog

- NAACOS In the News

- NAACOS Member News

- Press Releases & Letters

Download as PDF

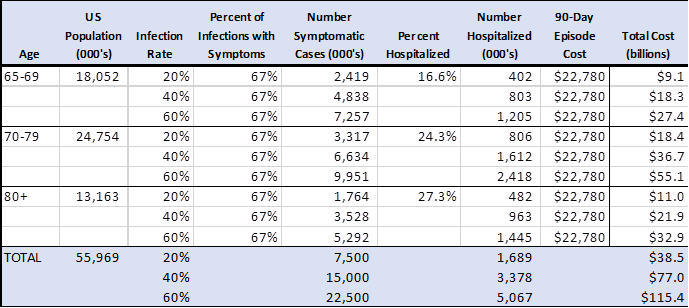

Background The ongoing COVID-19 pandemic will have a significant impact on Medicare spending over the next 12 to 18 months and beyond. This will be driven by an increased burden of serious illness among Medicare beneficiaries that will increase hospitalizations, use of intensive care units (ICU) and mechanical ventilation, and post-acute care. The financial impacts of this additional healthcare utilization will place a particular burden on healthcare organizations that participate in payment models linked to global budgets such as ACO programs. It will place a similar burden on Medicare Advantage plans. We have compiled initial estimates of the potential financial impact of COVID-19 on Medicare spending over the coming 12 months. There is relatively little information about the impact of COVID-19 on healthcare utilization. Much of the early evidence comes from countries outside the United States with healthcare systems that differ from the U.S. system. We provide a range of estimates based on simplifying assumptions that focus primarily on an increased need for hospital and related care. Preliminary Estimates We estimate the potential cost to Medicare of the COVID-19 epidemic over the next 12 months could range from $38.5 billion to $115.4 billion. These are gross spending estimates that could rise or fall depending on a variety of factors that are discussed briefly in the caveats section below.

Implications for ACOs About 20 percent of all Medicare beneficiaries are assigned to a Medicare Shared Savings Program (MSSP) or Next Generation (NextGen) Model ACO. Therefore, potential new COVID-related costs for Medicare ACO beneficiaries could range from $7.7 billion to $23.1 billion. Total spending for MSSP- and NextGen ACO-attributed beneficiaries was about $125 billion in 2018, so these COVID estimates represent a spending increase of 6 percent to 18 percent. In 2018, MSSP ACOs reduced spending by 1.6 percent on average relative to their benchmarks (spending targets) and NextGen ACOs reduced spending by 1.4 percent. Even under the lower-bound estimate, new spending of this magnitude would wipe out shared savings for the current performance year and create major losses for ACOs in models with downside risk. Methods To estimate the financial impact of COVID-19 on the Medicare spending, we used incidence rates and the average cost of a 90-day pneumonia hospitalization episode of care to determine potential new spending associated with the virus. The bundle includes index hospitalization costs as well as post-discharge inpatient rehabilitation, skilled nursing, home health, and ambulatory services associated with recovery from pneumonia. The cost estimate calculations are based on the following assumptions. Population. We use population data from the U.S. Census which breaks into the age ranges that align with the admission rate data discussed below.[1] This is not completely consistent with Medicare enrollment. We do not include Medicare beneficiaries under age 65 and some beneficiaries over 65 have other coverage as their primary payer. Infection rates and symptoms. We use a range of infection rates (20, 40 or 60 percent) given our limited understanding of population prevalence at this time.[2] The estimates assume that only two-thirds of infections are symptomatic and inpatient admission rates are based on symptomatic cases. Inpatient admission rates. Inpatient admission rates by age associated with COVID-19 were estimated by epidemiologists at the Imperial College of London and derived from experience in China.[3] New Medicare spending. As a proxy for new Medicare spending, we used the average per-episode spending for Medicare patients hospitalized with pneumonia including all clinically relevant services provided for 90 days after the index discharge.[4] Caveats The assumptions that underlie these estimates could change depending on the characteristics of the outbreak in the United States and the nature of the health care industries response.

[1]https://www.census.gov/prod/2014pubs/p25-1140.pdf [2] https://www.nytimes.com/interactive/2020/03/17/upshot/hospital-bed-shortages-coronavirus.html [3] Ferguson NM, Laydon D, Nedjati-Gilani G et al., (2020). Impact of non-pharmaceutical interventions (NPIs) to reduce COVID-19 mortality and healthcare demand. Imperial College COVID-19 Response Team. Downloaded March 18, 2020, https://www.imperial.ac.uk/media/imperial-college/medicine/sph/ide/gida-fellowships/Imperial-College-COVID19-NPI-modelling-16-03-2020.pdf [4] The Lewin Group, CMS Bundled Payments for Care Improvement Initiative Models 2-4: Tear 5 Evaluation & Monitoring Annual Report, downloaded March 18, 2020, https://downloads.cms.gov/files/cmmi/bpci-models2-4-yr5evalrpt.pdf. |